Foundations provides a low stress approach to the early stages of home ownership, bridging the gap between renting and buying and providing a stepping stone onto the housing ladder.

Greatly enhanced economics versus staying stuck in private rental

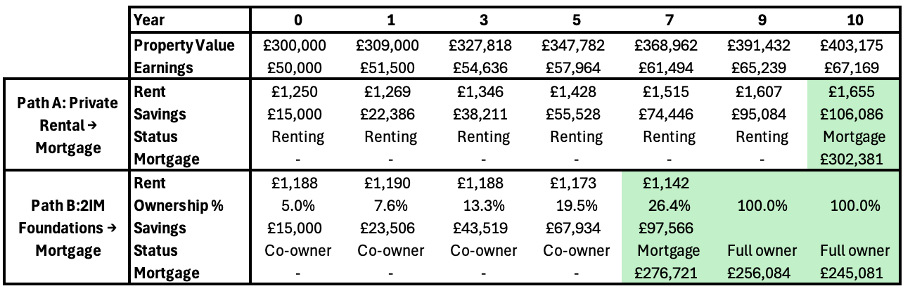

– Shortening the time to buy their first property from 10 to 7 years.

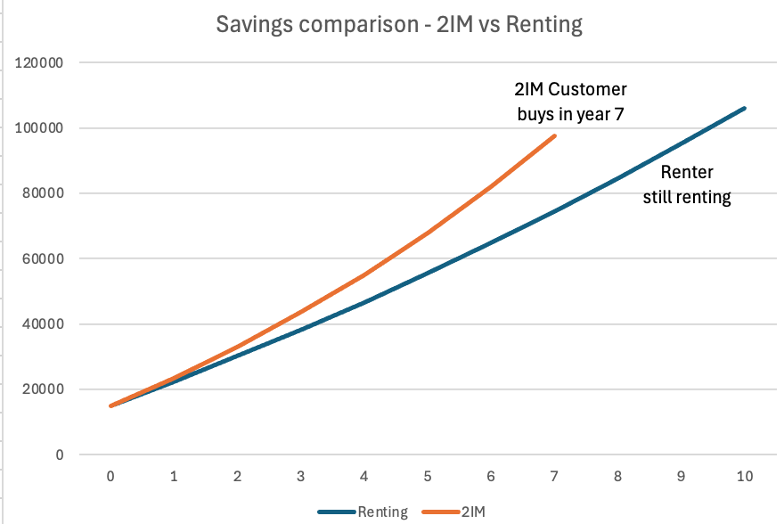

– Growing their savings 30% faster than if they had stayed in private rental

– A commitment and roadmap to buying their first property creating better saving discipline

– Buying earlier, they start out with a 10% smaller mortgage and will be mortgage free much earlier

Their choice of property – a first step on the ladder in the area they want to live, or perhaps where they work, where there may not be suitable properties to rent

Long term, confident outlook – security to put down roots and settle down as no eviction, long term financial security from rent increasing at inflation so immune from fluctuation in interest rates or rental yields, and the ability to make enhancements to make the property their own.

Flexibility around life events – unlike renting or paying a mortgage, 2IM Foundations gives the ability for up to a 6 month payment holiday to help through difficult times and reducing financial stress. If things don’t improve, they can sell their property. If things get better, they can buy with a mortgage or if they need more space they can upscale to a new bigger property under a new 2IM Foundations arrangement.

2IM Foundations – Lifecycle (for illustration only)

The following is based on our modelling of the current economic circumstances of aspiring homebuyers and is for illustration only.

Customer profile

– Professional couple – age 25

– Combined net income £50,000

– Have rented for last two years paying £1,250/month

– Strong payment history and good credit

– £15,000 in savings

Customer applies to 2IM to co-purchase a £300k property in a commuter town. 2IM likes the property and the couple and would consider this for the 2IM portfolio.

Year 0: Affordability and suitability assessment

Customer has a good rental history having rented a similar property for 2 years. Their income after tax is £40k and they currently pay £1,250 per month, equivalent to 37.5% of their net income.

They have good job prospects, have £15k in the bank and are currently saving £475/month. They have a good credit history with no CCJs.

Year 0: Customer and 2IM jointly purchase a property for £300,000.

Customer invests their £15k savings to purchase 5% of the property with 2IM investing £285k for the remaining 95% on an equity only basis. There is no mortgage as this allows 2IM to take first lien security and retain control of the arrangement.

They feel really lucky as the property is near their work where there has been no suitable rental property for some time but there are now reasonably priced properties available for sale.

They gain immediate access and their co-ownership status means they are immune from section 21 no-fault eviction. They can start to make the place their own and make plans for their future together.

2IM applies the local rental yield of 5%. Full rent on the property would be £1,250/month, but they own 5% so they only pay 95% of the full rent = £1,187. They are comfortable that this remains long term affordable in the knowledge the rent will simply increase at inflation while they live in the property.

Their friends who remain in private rental keep their deposit in the bank. They receive interest on this (on which they pay tax at their marginal rate of 40% which means their savings are not keeping pace with house price increases. Our Customer is comforted that their savings are invested in the property and grow tax-free with house prices. They also gain from a reduction in the rent. This allows them to save an extra £40 per month more than their friends. This effect is marginal at first but they can see it will have a bigger effect over time as they buy more of the property.

They commit to a plan to use their extra savings each year to buy more of the property so this effect is leveraged over time.

Year 2: Customer continues to use their growing savings to purchase further shares in the property.

By the end of year 2, the customer has consistently saved and invested, now having put a further £14.5k in the property, increasing their share to 10% and continuing to reduce the proportion the rent they pay which is now only £1,190 versus the £1,307 if in private rental.

This allows them to save a further £80/month more than if they were in private rental, which they leverage by continuing to build their share in the property and reduce their rental outgoings.

The property value has increased significantly over these two years helping their net worth grow tax efficiently.

Year 4: Customer has life event and applies for a payment holiday of 6 months

Unfortunately in year 4 a Life Event occurs and they apply for a 6 month payment holiday.

By this point, the customer has saved and invested a further £36.4k in the property, increasing their share to 16% and the rent they pay is now only £1,181 versus the £1,386 they would be paying were they still to be in private rental and allows them to save a further £140/month more.

Rent on 2IM’s share over this 6 month period would be £7,092, roughly 2.1% of the property. The customer agrees to sell this share to 2IM in consideration for the payment holiday, reducing their share to 13.9%.

After the 6 month payment holiday, the customer notes the extra cash cushion gave them comfort during this time but is happy that their financial situation has not suffered and they can repurchase their 2.1% share, increasing their total back to 16%.

Year 6: Customer continues to increase their share and is getting closer to becoming eligible for a mortgage

By the end of year 6, the customer has saved and invested a further £59.5k in the property, increasing their share to 23% and their net worth (the value of their share given the property has appreciated in price) has increased to £82k, £17k more than if they had stayed in renting.

The rent they pay is now £1,159 versus the £1,471 they would be paying were they still to be in private rental and allows them to save a further £221/month.

Although their finances are improving much quicker than they had anticipated, they are disappointed to find they still cannot get a mortgage large enough to buy out 2IM’s share of the property. The property is now worth £358k and 2IM’s share £276k but even with their earnings now having risen to £59,700, the 4.5x borrowing multiple only allows them to borrow £268k.

Disappointed, they resolve to continue to save, knowing that they are now close to getting a mortgage and comforted by the fact they have been living in their own home now for 6 years, have got married and started a family.

Year 7: Customer becomes eligible for mortgage and buys out 2IM share to collapse the arrangement.

By this point, the customer has grown their share to 26%, now worth £97,500 that becomes the deposit collateral against their new mortgage. The house is now valued at £368k and they get can a £271k mortgage (roughly 4.4x their earnings). They can now take the mortgage to purchase the remainder of 2IM’s share of the property and obtain full ownership of their existing property.

They speak to friends who continued in private rental who are now paying over £1500/month in rent and have still not settled down, waiting for their own home. They have moved 3 times in this period and are now not able to find accommodation near their work and are having to commute a long way across town. They have got married but haven’t yet started a family as they don’t have the space or security of owning their own home.

They are not expecting to be able to buy for at least another 3 years, assuming conditions remain favourable, by which they think they will need to pay over £400k for the property and their mortgage over £300k. They are wondering whether this is worth it as they are concerned the financial stress will restrict their standard of living and delay their retirement.

Year 7 onwards: The future

Our 2IM customer can happily live in their home they now own and continue to save to pay off their mortgage.

They do have another option – given their growing family, they could enter into a new arrangement with 2IM to upsize bigger property and set a new plan for the future.

Comparative Journey Summary

Private Rental vs. 2IM Foundations