“I can rent, but I can’t buy!”

Buyers can co-invest with 2IM

without a mortgage –

providing a stepping stone

onto the property ladder.

Part buy-part rent

The new buy-to-let

Traditional buy-to-let business model is broken, driving more and more landlords to exit.

2IM provides a new route – coinvesting alongside aspiring homebuyers in a more efficient, part buy/part rent approach.

Available on

ANY property

Applicable to any property currently for sale, co-investment allows access to a much greater choice of established properties.

Coinvestment reduces risk with long term, motivated, credit-worthy owner/occupier tenants.

Compelling

economics

2IM targets net returns of 7-10% (4% net rental yield plus HPI), substantially out-performing BTL.

Attractive risk adjusted returns are achieved through 200bps+ of cost efficiencies over BTL, while retaining structural protection.

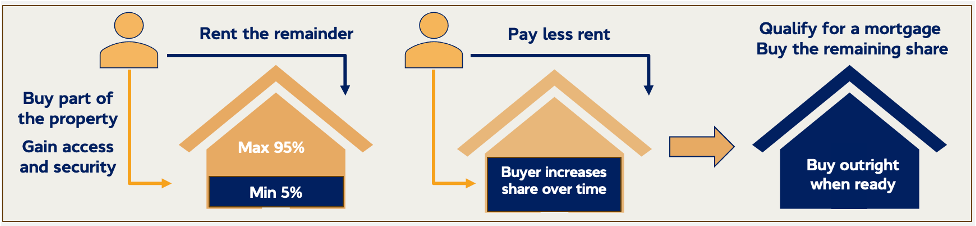

How does co-ownership work?

We crowd-source origination – allowing aspiring buyers to suggest the properties they want to buy to 2IM. We believe local buyers know their local market better than anyone. The tenant must want to buy the property over time so they need to love it – same as when buying outright.

This extends the buyer’s purchasing power by circa 50%, using their track record of rental payments to assess affordability and get on the ladder earlier.

Both the property and the buyer are assessed and approved by 2IM prior to purchase. 2IM selects the best combination of buyer and property that will provide an investment over a reasonable term.

Each property will be purchased on a joint basis on an equity/equity basis. There is no third party mortgage which allows 2IM to retain control. Successful applicants become part owner/part tenant of their property, gaining sole occupancy in exchange for paying market rent on the 2IM share.

The buyer pays rent on the share owned by 2IM, in exchange for sole access to the property. This rent increases each year at inflation.

No need for letting agents or property managers. The buyer rents the investor share for the term of the arrangement and is responsible for managing their property, under the oversight of 2IM, providing huge cost savings for investors.

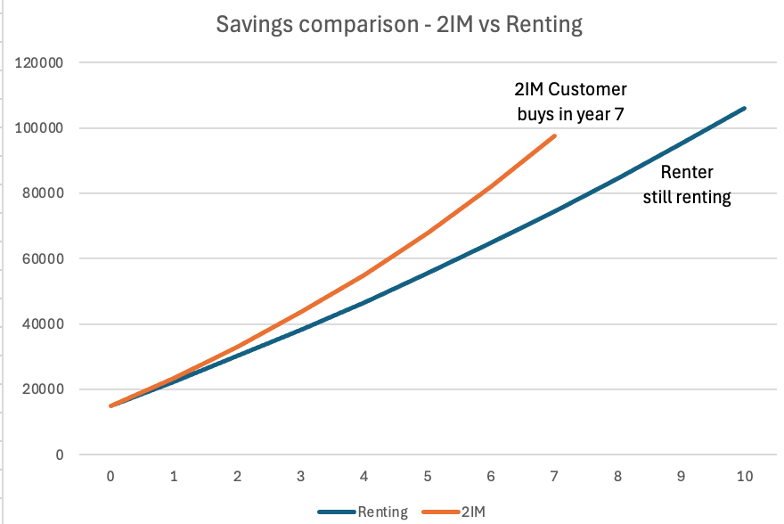

The buyer can purchase more of the property at prevailing market value when they can afford to do so. This reduces the amount of rent they have to pay, increasing their saving potential to get to a mortgage faster.

The transaction comes to a natural end when the buyer qualifies for a mortgage. We anticipate each transaction will exit in 3-7 years – greatly reducing the length of time taken for the Buyer to get to mortgage and buy the remainder of the property.

About 2IM

2IM is a team of highly experienced team of investment professionals that have come together with a unique and ground-breaking investment strategy and the express purpose of helping aspiring buyers and investors engage more effectively in the UK housing market.

We recognised investors have struggled with the cost and operational intensity of investing in scale in UK housing, leading to an army of sub-scale private rental landlords in place of institutional investment, deteriorating sector quality and a deepening housing crisis. We see this as an opportunity to professionalise the sector while helping aspiring homebuyers get on the housing ladder.

A specialist investor in UK single family homes, 2IM engages the market via a unique, highly efficient co-investment approach – enabling 2IM to uniquely access quality established homes with quality long term tenants and minimising gross to net leakage to maximise investor returns.

Innovation at every stage

We believe the housing market needs change and private rental is ripe for disruption.

2IM’s vision for the future harnesses the latest developments in technology and financial structuring to provide even small investors the ability to invest in a diversified portfolio with outsourced management, rather than having to risk managing a single property themselves.

Consumer engagement

We recognise that the people that know local markets best are the ones that live there.

2IM has partnered with the homely.co.uk platform to engage aspiring homebuyers. This allows 2IM to crowdsource investment origination and provides the perfect property management interface for 2IM’s owner/occupiers.

Dedicated investment management

2IM delivers unique solutions to investors that address the key challenges in today’s market.

Centralised investment and property management capabilities, operating at scale, are able to add substantial value, whilst our dedication to this sector ensures our focus remains on the ball.

Cost efficient operations

2IM’s structure allows us to substantially reduce costs, thereby enhancing investor returns without the associated risk.

Our unique long term tenancy arrangement allows us to realise cost efficiencies such as removing the need for letting and managing agents and reducing stamp duty.

2IM offers value to all investors –

banks, insurers, pension funds

and private investors alike …

Target 7-10% net, after all costs

We target a net running yield (after all costs) of 4.0% in addition to house price inflation of up to 4-7% (Savills, August 2025).

Banks and

Building Societies

Highly capital efficient diversifier and compelling alternative to BTL and high LTV mortgages.

Mortgage risk weights and attractive net returns provide a highly attractive RoTE

Affordability is assessed on rental history and not limited by Loan to Income ratio.

Insurers and

Pension Funds

Attractive long term, inflation linked income from a predictable and well understood asset class.

Tangible social impact in transforming opportunity of aspiring homebuyers.

Potential to structure for cashflow matching.

Family Offices and

Private Investors

Compelling alternative for BTL investors, out-performing returns while mitigating tenant risk.

Focus on established properties allows diversification away from Buy-to-Let type property

Our Team

2IM is a team of highly experienced specialists in the real estate and alternative investment space with an average experience of over 25 years.

Steven Ward

MAnagING PARTNER

CEO, HSBC AlternatIve Investments LTd. 2016-22, responsible for $42bn

INCLUDING $4bn real estate

Adrian Jones

CHIEF INVESTMENT OFFICER

LEAD PORTFOLIO MANAGER

£75m ALLIANZ HOME EQUITY INCOME FUND

EXPERIENCED REAL ASSET FINANCIER

Andries Hoekema

CHIEF COMMERCIAL OFFICER

FORMERLY

head of solutions and insurance segment, HSBC ASSET MANAGeMENT

Will German

ADVISER, RISK AND OPERATIONS

formerly

CEO, HELP TO BUY,

HOMES EnGLANd

Muhammed Patel

ADVISER, OPERATIONS AND INVESTOR RELATIONS

strategy and

investor relations director,

Foxtons

Farid Anvari

LEGAL, COMPLIANCE & REGULATORY AFFAIRS

head EU government relations, cme

former partner aT baker and MACKENZIE

Would you like to hear more?

We ‘re looking to build a group of like mind investors willing to work together to explore new ways of doing things better. Feel free to contact us to ask any questions.

Together, we’ll make it happen.

Explore Our Thought Leadership

2IM Lifecycle – 2IM Foundations completely transforms opportunity for first time buyers.

Foundations provides a low stress approach to the early[…]

Beyond Build-to-Rent: Why Established Housing Offers Superior Risk-Adjusted Returns

The UK institutional investment community has committed £15bn to[…]

The Great BTL Unwind: £300bn of Residential Property Seeking New Capital

The UK is witnessing the largest shift in property[…]

Contact us

Please contact us for more information